Introduction

Investing in a company can be a big decision. You want to make sure you choose wisely. But how do you know if a company is worth investing in?

Understand the Company

The first step is to understand the company. You need to know what the company does. Look at their products or services. Are they unique or special? Do people want to buy them?

Check the Financial Health

You also need to check the company’s financial health. This means looking at their financial statements. These are documents that show how much money the company makes and spends.

- Income Statement: Shows how much money the company made and spent over a period of time.

- Balance Sheet: Shows what the company owns and owes at a specific point in time.

- Cash Flow Statement: Shows how much cash comes in and goes out of the company.

Look at the Management Team

The people running the company are very important. Look at the management team. Do they have a good track record? Have they been successful in the past?

Check the Competition

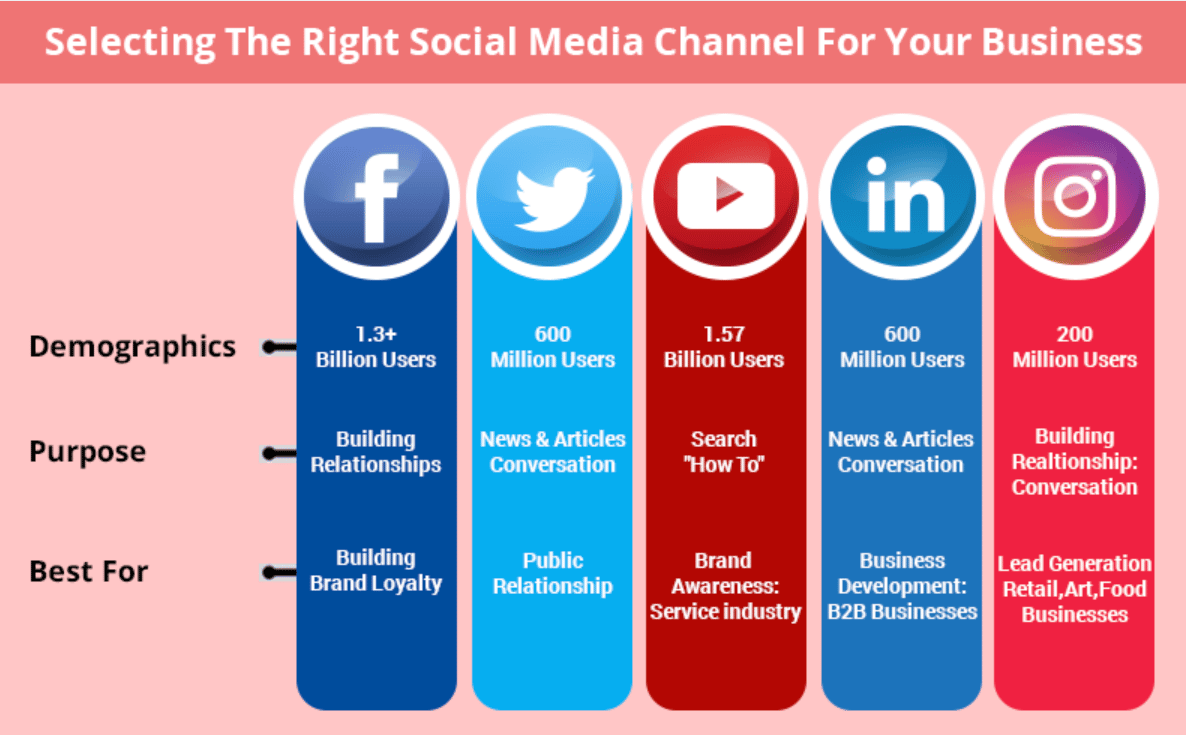

You also need to look at the competition. Are there many other companies doing the same thing? If yes, what makes this company better?

Look at the Market

The market the company is in is also important. Is it growing? Are there more people buying these products or services?

Check the Company’s Growth

Look at how the company has grown over the years. Are they getting bigger and better? Companies that grow are usually good investments.

Look at the Company’s Debt

Debt can be a big problem for companies. Look at how much debt the company has. Too much debt can be a bad sign.

Check the Company’s Dividends

Some companies pay dividends to their investors. This is money that the company gives to its shareholders. If a company pays dividends, it can be a good sign.

Look at the Company’s Valuation

Valuation means how much the company is worth. You don’t want to pay too much for a company. Look at the company’s stock price. Is it too high or just right?

Check the News

Look at the news about the company. Are there any good or bad stories? This can give you an idea of how the company is doing.

Look at the Company’s Plans

Check what the company plans to do in the future. Do they have new products coming out? Are they expanding into new markets?

Ask Experts

Sometimes it’s good to ask experts. They can give you more information about the company. You can talk to financial advisors or read expert reviews.

Frequently Asked Questions

How To Evaluate A Company’s Financial Health?

Examine their balance sheet, income statement, and cash flow.

What Are Key Metrics To Check?

Look at P/E ratio, ROE, and debt levels.

Is Management Quality Important For Investment?

Yes, strong leadership drives company success and growth.

Should I Consider Market Trends?

Yes, market trends influence a company’s future performance.

Bottom Line

Choosing a company to invest in can be hard. But if you do your homework, you can make a good decision. Look at the company’s products, financial health, management, competition, and market. Check their growth, debt, dividends, valuation, news, and future plans. And don’t forget to ask experts for advice.

Related Content

When is the Best Time to Buy Investment Property? Expert Insights

When is the Best Time to Sell Investment Property?

What are the Advantages of Investing in Mutual Funds?

How Many Venture Capital Firms are There in the US?

What is the Main Difference between an Angel Investor And a Crowdfunding Investor?

Why is Venture Capital Better Than a Bank Loan? Discover Key Benefits

What are the Most Important Business And Economic Trends in Canada?

Business in the USA vs. Canada: Key Insights Unveiled

Why is Venture Capital Better Than a Bank Loan? Discover Key Benefits

How to Get Angel Investors for My Business: Proven Strategies